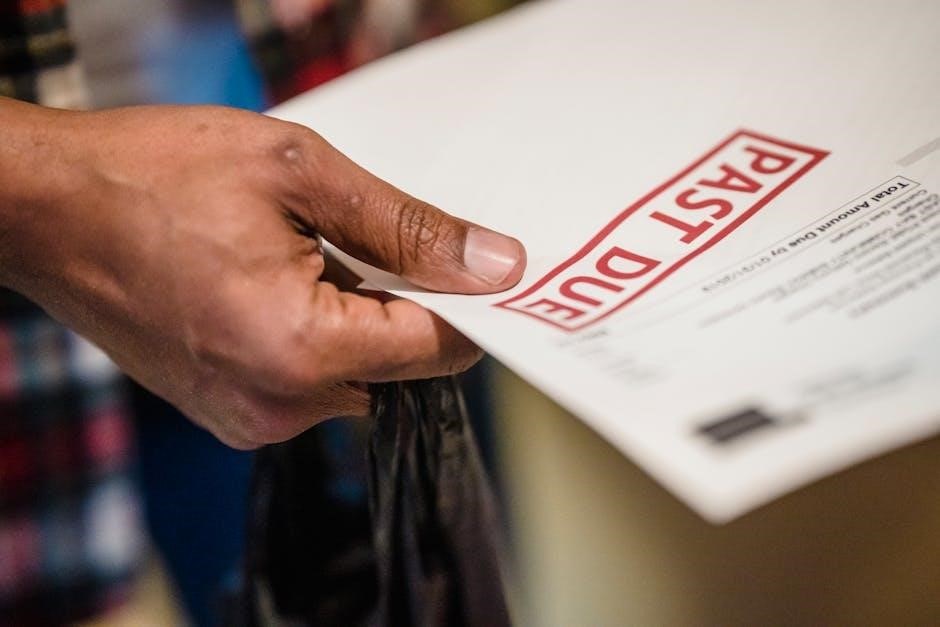

What is the Debt Snowball Method?

The Debt Snowball Method is a popular strategy for paying off debts by focusing on smaller balances first, building momentum and motivation through quick wins.

The Debt Snowball Method is a debt reduction strategy where you pay off debts starting with the smallest balance first, while making minimum payments on larger ones. This approach builds momentum as quick wins motivate you to stay on track. By focusing on smaller debts, you free up more funds to tackle larger ones, creating a “snowball” effect. It’s a simple, psychological approach that helps individuals stay committed to their debt-free goals. Worksheets and spreadsheets, like the Debt Snowball Worksheet, are essential tools for organizing and tracking progress. For example, if you owe $50, $100, $150, and $200, you’d pay the $50 debt first, then apply the $50 payment to the next smallest debt, and so on, until all debts are paid off. This method emphasizes behavior change and celebrates small victories, making it easier to stick to your plan.

Why Use the Debt Snowball Method?

The Debt Snowball Method is favored for its psychological benefits, providing quick wins that boost motivation. By paying off smaller debts first, individuals experience early successes, which encourages consistency. This approach is simple to understand and implement, making it accessible for those new to debt management. The method also fosters discipline, as it requires committing to a structured payment plan. Worksheets and spreadsheets, such as the Debt Snowball Worksheet, help track progress visually, reinforcing achievements. Unlike other methods, the snowball approach doesn’t require complex financial analysis, focusing instead on behavior change and gradual debt elimination. Over time, the momentum gained from paying off smaller debts accelerates the payoff of larger ones, leading to financial freedom. This method is particularly effective for those who need moral victories to stay committed to their goals.

How to Use the Debt Snowball Worksheet

Start by listing all debts from smallest to largest; Make minimum payments on all except the smallest, applying extra funds to eliminate it first. Once paid, roll the freed funds into the next debt, accelerating progress toward financial freedom.

Step-by-Step Guide to Completing the Worksheet

Start by listing all your debts, including balances, interest rates, and minimum payments. Arrange them from smallest to largest balance. Calculate your total monthly payments and identify any extra funds available for debt repayment. Apply the extra funds to the smallest debt while paying minimums on others. Once the smallest debt is paid off, roll the freed-up money into the next debt, repeating the process. Track your progress monthly, updating the worksheet to reflect payments made and remaining balances. This systematic approach helps maintain focus and motivation as you work toward becoming debt-free. Regular updates ensure accuracy and keep you on track to achieving financial freedom.

Listing Debts from Smallest to Largest

Begin by listing all your debts, starting with the smallest balance and moving to the largest. Include the creditor’s name, current balance, interest rate, and minimum payment for each debt. This step ensures clarity and helps prioritize which debts to tackle first. For example, if you owe $500 on a credit card, $1,000 on a personal loan, and $10,000 on a car loan, the credit card debt should be addressed first. Organizing debts this way allows you to focus on quick wins, building momentum and confidence. Be sure to include all debt types, such as credit cards, loans, and mortgages, to get a comprehensive view of your financial obligations.

Calculating Monthly Payments and Extra Contributions

After listing your debts, calculate the minimum monthly payment for each. Add an extra contribution amount you can afford to pay beyond the minimum. This step helps accelerate debt repayment. Use the Debt Snowball Worksheet to organize these calculations. For example, if you have a $500 credit card balance with a $25 minimum payment, and you can afford an extra $50, your total monthly payment becomes $75. Apply this extra amount to the smallest debt first, while paying the minimum on others. This strategy builds momentum as smaller debts are quickly paid off, freeing up more funds for larger ones. Regularly update your calculations to reflect progress and adjust contributions as needed to stay on track. This approach ensures you maximize your payments effectively.

Tracking Progress and Adjusting Payments

Tracking your progress is essential to staying motivated and ensuring your debt repayment plan remains effective. Use your Debt Snowball Worksheet to log each payment, updating balances and marking off debts as they’re paid. This visual progress helps maintain momentum. Regularly review your budget to identify opportunities to increase contributions or adjust payment amounts. If extra funds become available, allocate them to the next debt in your list. Adjustments may also be needed if income changes or unexpected expenses arise. By consistently monitoring and adapting your payments, you can stay on course and achieve debt freedom faster. This step ensures flexibility and accountability, keeping you committed to your financial goals. Regular updates also help celebrate milestones, reinforcing the progress made so far.

Reviewing and Updating the Plan Regularly

Regularly reviewing and updating your Debt Snowball Plan is crucial for long-term success. Set aside time each month to assess your progress, ensuring all payments are up to date and debts are being addressed in the correct order. Use your worksheet to verify balances, update paid-off debts, and adjust payment amounts if needed. Celebrate milestones, like paying off a debt, to stay motivated. Reflect on your budget to identify areas where you can allocate more funds toward debts. If financial circumstances change, such as income increases or unexpected expenses, revise your plan accordingly. This flexibility ensures your strategy remains effective and aligned with your goals. Regular reviews also help you stay accountable and focused on achieving debt freedom.

Debt Snowball vs. Other Debt Reduction Methods

The Debt Snowball Method focuses on paying off smaller debts first, while other methods like the Debt Avalanche prioritize high-interest debts, offering different approaches to debt reduction.

Comparing the Debt Snowball and Debt Avalanche Methods

The Debt Snowball Method focuses on paying off debts with the smallest balances first, providing psychological motivation through quick wins. In contrast, the Debt Avalanche Method prioritizes debts with the highest interest rates, potentially saving more money over time. While the Snowball method builds momentum, the Avalanche method reduces overall interest paid. Both strategies require discipline, but the choice depends on individual financial goals and preferences. The Debt Snowball is often preferred for its emotional benefits, while the Avalanche is favored for its mathematical efficiency. Understanding these differences helps individuals choose the best approach for their debt reduction journey.

Understanding the Debt Tsunami Method

The Debt Tsunami Method is a hybrid approach combining elements of the Debt Snowball and Avalanche methods. It prioritizes debts based on factors like interest rates, balance size, and personal urgency. This method allows for customization, enabling individuals to tackle high-interest or emotionally significant debts first while still benefiting from the momentum of quick wins. Unlike the Snowball method, which focuses solely on balance size, or the Avalanche, which centers on interest rates, the Tsunami method offers flexibility. It’s ideal for those seeking a tailored strategy that aligns with their financial goals and emotional priorities, making it a versatile option for debt repayment.

Choosing the Best Method for Your Financial Situation

Selecting the right debt repayment method depends on your financial goals, personality, and situation. The Debt Snowball method is ideal for those motivated by quick wins, as it prioritizes smaller debts first. In contrast, the Debt Avalanche method suits individuals focused on minimizing interest costs by tackling high-interest debts first. The Debt Tsunami method offers flexibility, allowing you to prioritize debts based on personal urgency or emotional significance. Consider your income stability, emergency fund status, and debt composition when deciding. Using a debt snowball worksheet can help organize your debts and clarify which method aligns best with your financial priorities, ensuring a tailored approach to becoming debt-free.

Benefits of Using the Debt Snowball Worksheet

The Debt Snowball Worksheet simplifies debt management by tracking progress, calculating payments, and visualizing your path to becoming debt-free. It provides clarity, motivation, and a sense of accomplishment as you see debts being paid off, helping you stay committed to your financial goals.

Psychological Advantages of Quick Wins

The Debt Snowball Method leverages the power of quick wins to boost motivation and morale. By paying off smaller debts first, individuals experience a sense of accomplishment and progress, which reduces stress and builds confidence. These early victories create a positive feedback loop, encouraging consistent effort and reinforcing the belief that debt freedom is achievable. The psychological benefits of visible progress often outweigh the mathematical efficiency of other methods, making the journey feel more manageable and rewarding. This approach helps individuals stay committed to their financial goals, even when facing larger or higher-interest debts down the line.

Clarity and Simplicity in Debt Management

The Debt Snowball Method offers unparalleled clarity and simplicity in debt management. By organizing debts from smallest to largest, individuals can easily prioritize payments without feeling overwhelmed. The structured approach provides a clear roadmap, making it easier to stay on track. Worksheets and trackers visualize progress, allowing users to see how each payment contributes to their goal. This transparency builds confidence and reduces financial stress. The method’s focus on one debt at a time simplifies decision-making, eliminating the need for complex strategies. Its user-friendly nature makes it accessible to everyone, ensuring that even those new to debt management can navigate their path to financial freedom with ease and clarity.

Motivation Through Visible Progress

The Debt Snowball Method excels at maintaining motivation by providing clear, visible progress. Paying off smaller debts first creates a sense of accomplishment, which fuels determination to continue. Worksheets and trackers visually illustrate each step, allowing users to see their advancements. This tangible evidence of progress reinforces commitment and encourages consistency. The method’s focus on quick wins builds momentum, making the journey feel achievable. As debts are crossed off the list, the psychological boost propels individuals forward, keeping them motivated to tackle larger debts. The visible reduction in debt burden strengthens resolve, ensuring sustained effort until financial freedom is achieved. This approach ensures users stay engaged and driven throughout their debt repayment journey.

Common Mistakes to Avoid When Using the Debt Snowball

Ignoring larger debts with higher interest rates and not maintaining emergency funds are common pitfalls. Stopping the plan prematurely can hinder progress toward debt freedom.

Ignoring Interest Rates on Larger Debts

A common mistake is neglecting to consider interest rates on larger debts when using the Debt Snowball Method. While paying off smaller debts first provides psychological benefits, focusing solely on balance size may lead to paying more in interest over time. For example, if you have a large debt with a high interest rate, it could accumulate significant interest while you focus on smaller, low-interest debts. This oversight can cost you more money in the long run. To optimize your strategy, consider combining the Debt Snowball Method with some principles of the Debt Avalanche Method, which prioritizes high-interest debts first. This hybrid approach balances emotional motivation with financial efficiency, ensuring you minimize total interest paid while still achieving quick wins. By addressing both balance size and interest rates, you can create a more effective plan to become debt-free.

Not Accounting for Emergency Funds

One critical error when using the Debt Snowball Method is failing to account for emergency funds. While focusing on paying off debts, it’s easy to overlook the importance of building a financial safety net. Unexpected expenses, such as car repairs or medical bills, can derail your progress and force you to take on more debt. Without an emergency fund, you may be tempted to pause your debt repayment plan or even borrow additional money. To avoid this, it’s essential to set aside a small emergency fund before dedicating extra money to debt repayment. This cushion will protect you from setbacks and ensure you can continue your debt-free journey without interruption. Balancing debt repayment with emergency savings is crucial for long-term financial stability.

Stopping the Plan Before Completion

One of the most significant mistakes when using the Debt Snowball Method is stopping the plan before completion. Many individuals lose motivation when they don’t see immediate results, especially if larger debts remain. However, consistency is key to achieving financial freedom. Stopping midway can lead to accumulating more debt, as progress is lost, and momentum fades. Without completing the plan, you risk undoing the efforts already made, such as paying off smaller debts. It’s important to stay committed and remind yourself of the long-term benefits. Even if progress feels slow, continuing the plan ensures you’ll eventually achieve a debt-free life. Halting the process only delays financial stability and can lead to further financial strain. Stay disciplined and push through to complete the plan for lasting results.

Case Studies and Success Stories

Real-life examples demonstrate how individuals achieved debt freedom using the Debt Snowball Method with worksheets, proving its effectiveness in transforming financial situations and building lasting stability.

Real-Life Examples of Debt Snowball Success

Many individuals have achieved remarkable financial breakthroughs using the Debt Snowball Method. For instance, one user paid off $15,000 in credit card debt within two years by prioritizing smaller balances first. Another couple eliminated $30,000 in student loans and credit card debt in just three years, leveraging the momentum from quick wins. These success stories highlight how the method’s focus on psychological motivation helps maintain discipline and consistency. By using worksheets to track progress, individuals gain clarity and stay committed to their debt-free goals. Such examples demonstrate the practical effectiveness of the Debt Snowball Method in transforming financial lives and achieving lasting stability.

How Others Achieved Debt Freedom

Countless individuals have successfully attained financial freedom by utilizing the Debt Snowball Method. One inspiring example is Sarah, who eliminated $20,000 in debt within three years by consistently applying extra payments to her smallest balances. John, a teacher, paid off $50,000 in student loans and credit card debt by combining the Debt Snowball approach with a strict budget. These success stories emphasize the importance of discipline, tracking progress with worksheets, and celebrating small victories. By staying committed to the method, they transformed their financial lives and achieved lasting stability. Their journeys serve as motivation for others to adopt the Debt Snowball strategy and work toward their own debt-free future.

Best Resources for Debt Snowball Worksheets

Top resources offer free PDF templates, Google Sheets, and Excel spreadsheets to track debt repayment. Vertex42 and Spreadsheet Daddy provide customizable tools to visualize progress and calculate payments effectively.

Top Free PDF Templates Available Online

Several websites offer free PDF templates designed to help users implement the Debt Snowball Method. These templates are downloadable and printable, providing structured formats to list debts, track payments, and visualize progress. They often include sections for detailing debt amounts, interest rates, and monthly payments, as well as spaces to record extra contributions. Popular platforms like Canva and August Freckles offer visually appealing and user-friendly designs. Additionally, some templates include motivational elements, such as debt thermometers, to help users stay encouraged throughout their debt repayment journey. These tools are ideal for individuals who prefer a hands-on approach to managing their finances and staying organized. Using a PDF template can make the process of paying off debt feel more tangible and achievable.

Recommended Spreadsheets for Google Sheets and Excel

For effective debt management, several recommended spreadsheets are available for Google Sheets and Excel. The Debt Snowball Spreadsheet by Spreadsheet Daddy is a top choice, offering a structured format to list debts, calculate payments, and track progress. Vertex42’s Debt Payoff Calculator is another excellent option, providing detailed insights into repayment plans and interest savings. Template LAB’s Debt Snowball Worksheet for Excel simplifies the process with a user-friendly interface. These tools automate calculations, such as monthly payments and payoff timelines, and allow customization to fit individual financial situations. They are ideal for those who prefer digital tracking and want to apply the Debt Snowball Method efficiently. These spreadsheets help users stay organized and motivated as they work toward becoming debt-free.

Where to Find Printable Debt Snowball Trackers

Printable Debt Snowball Trackers can be easily found on various websites offering financial planning tools. Canva provides free, customizable templates with visually appealing designs to track progress. Etsy offers affordable printable PDFs tailored for specific needs, such as budgeting and debt management. Google Sheets and Excel templates from sites like Spreadsheet Daddy and Vertex42 are also popular, offering editable spreadsheets to list debts, calculate payments, and monitor milestones. Additionally, personal finance blogs like August Freckles and Well Kept Wallet share free downloadable trackers. These resources help users stay organized and motivated, making the Debt Snowball Method accessible and user-friendly. They are ideal for those who prefer physical copies or digital versions to visualize their journey to becoming debt-free.

Advanced Strategies for Debt Snowball Success

- Incorporating the Debt Snowball with Other Methods: Combining the debt snowball with avalanche or tsunami methods can optimize payoff strategies.

- Using Automation: Setting up automatic payments ensures consistent progress and reduces the risk of missed payments.

- Adjusting Income: Increasing income through side hustles or selling items accelerates repayment and enhances the snowball effect.

Incorporating the Debt Snowball with Other Methods

The Debt Snowball Method can be combined with other strategies like the Debt Avalanche or Debt Tsunami for enhanced results. For example, starting with the Snowball for motivational quick wins and switching to the Avalanche for higher-interest debts can optimize savings. Additionally, integrating the Tsunami method for urgent debts ensures critical obligations are prioritized. This hybrid approach allows for flexibility, balancing psychological momentum with financial efficiency. By tailoring the strategy to individual needs, users can maximize progress and achieve debt freedom faster. This combination also helps in managing diverse debt types, such as credit cards, loans, and mortgages, ensuring a comprehensive repayment plan.

Using Automation for Consistent Payments

Automation is a powerful tool to ensure consistent payments while using the Debt Snowball Method. By setting up automatic transfers through your bank or budgeting apps like Mint or You Need A Budget (YNAB), you can streamline your debt repayment process. Spreadsheets, such as Google Sheets or Excel templates, can also be programmed to calculate and track payments automatically, reducing manual effort. Automation helps avoid missed payments, ensures timely progress, and maintains momentum. Additionally, linking your debt worksheet to budgeting tools allows for real-time updates, making it easier to stay on track; This approach minimizes the risk of oversights and keeps your debt repayment plan organized and efficient.

Adjusting Income to Accelerate Debt Repayment

Adjusting your income can significantly accelerate debt repayment when using the Debt Snowball Method. Consider increasing your earnings through side hustles, freelancing, or part-time jobs to allocate more funds toward your debts. Selling unused items, renting out space, or pursuing gig economy opportunities can also boost your income. Additionally, optimizing your budget to reduce unnecessary expenses allows more money to be directed toward debt payments. You can also explore ways to enhance your skills or negotiate a raise at your current job. By increasing your income and streamlining expenses, you create a powerful combination that speeds up your debt repayment journey and helps you achieve financial freedom faster.

Frequently Asked Questions About the Debt Snowball

Q: Does the Debt Snowball Method work for all kinds of debt?

A: Yes, the Debt Snowball Method works for various debts, including credit cards, loans, and mortgages, helping you achieve a debt-free journey effectively.

Does the Debt Snowball Work for All Kinds of Debt?

The Debt Snowball Method is effective for various types of debt, including credit cards, personal loans, and mortgages. It works by prioritizing smaller debts first, creating a sense of accomplishment that motivates individuals to continue. This approach is particularly beneficial for those who need psychological boosts to stay committed. However, it may not always be the most efficient for high-interest debts, where the Debt Avalanche Method might be better. Regardless, the Debt Snowball is a flexible strategy that can be adapted to suit different financial situations, making it a popular choice for many seeking to become debt-free.

How Long Does It Take to Pay Off Debt Using the Snowball Method?

The time to pay off debt using the Snowball Method varies depending on the size of the debts, interest rates, and the amount of extra funds available. Smaller debts are paid off quickly, providing motivation. For larger debts, the process can take longer, but the momentum built from earlier successes helps maintain commitment. Using tools like a Debt Snowball Worksheet or spreadsheet can provide a clear timeline and track progress. Consistent payments and avoiding new debt are key to completing the plan efficiently. Over time, the method builds financial discipline, leading to long-term debt freedom.

Can I Use the Debt Snowball Method If I Have No Extra Income?

Using the Debt Snowball Method with no extra income is challenging but possible by strictly adhering to minimum payments. Focus on smaller debts first to gain momentum. Explore ways to increase income, such as side jobs or selling items, to allocate more funds. Without extra income, progress will be slower, but consistent payments maintain control. Tools like Debt Snowball Worksheets help track progress and stay motivated. Patience and discipline are crucial for long-term success. Even with limited resources, the method provides a clear plan to achieve financial freedom over time.

Summarizing the Effectiveness of the Debt Snowball

The Debt Snowball Method is a proven strategy for achieving financial freedom by prioritizing smaller debts first, creating momentum and motivation through quick wins.

The Debt Snowball Method has proven to be an effective strategy for achieving financial freedom by focusing on paying off smaller debts first. This approach builds momentum and motivation through quick wins, helping individuals stay committed to their debt repayment journey. By prioritizing smaller balances, users can rapidly eliminate debts, freeing up more funds to tackle larger ones. The method’s simplicity and psychological benefits make it accessible and sustainable for many. With the help of a debt snowball worksheet, users can track progress, visualize their goals, and maintain accountability. Over time, this method not only reduces debt but also fosters long-term financial health and discipline.

Encouraging Readers to Start Their Debt-Free Journey

Embracing the Debt Snowball Method is a powerful first step toward financial freedom. By organizing debts and tracking progress with a worksheet, individuals can regain control of their finances. The method’s focus on quick wins provides the motivation needed to stay consistent. Even small steps, like paying off a credit card, can build confidence and reinforce the habit of saving. With free resources like PDF templates and spreadsheets available, there’s no better time to begin. Committing to this journey not only reduces debt but also fosters a healthier relationship with money. Start today, and watch your financial future transform for the better.